PROJECT PORTFOLIO

Our Development Principles are Based on Simple Designs and Clean Colors

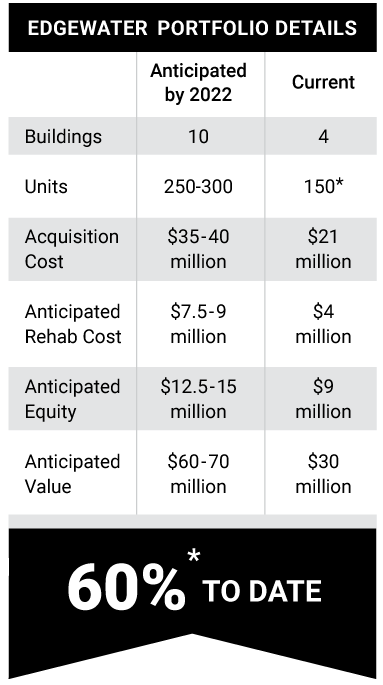

Edgewater “Value Added” Multi-Family Investment Thesis and Portfolio

Property Locations

NEW PROJECTS

Fairchild Towers

5710 N Winthrop Lakewood, Chicago

Property acquired in September 2020. This 42-unit, $5.3 million dollar investment consists of twenty-five one-bedroom units and seventeen studio units. Fairchild Acquisition plans to start construction Dec 2020 and anticipates 18-24 months to complete at an estimated rehabilitation cost of $1 million. Total equity that has been secured is $2.0 million with an anticipated hold period of five years. We estimated 18-24 months to redevelop this project with plans to refinance in month twenty-four for approximate 50% equity return.

ON-GOING

Fairchild Commons

6565 Lakewood, Chicago

Property acquired in June 2019. This $5.5 million dollar acquisition has 39 units with an estimated development cost of $1.018 million. Development began in September 2019, with an estimated completion date June 2020, eight months ahead of schedule. We anticipate stabilization and cash out refinance in November 2020. Just sixteen months after purchase, proceeds should allow 45% initial equity repayment, and cash on cash 8-10% annually. Anticipated returns are 3.1X cash on cash, a 20% IRR, and an 8.1% “as complete" stabilized cap rate.

ON-GOING

Fairchild Court

6000 N Winthrop, Chicago

Property acquired in June 2019. This $5.5 million dollar acquisition has 39 units with an estimated development cost of $1.018 million. Development began in September 2019, with an estimated completion date June 2020, eight months ahead of schedule. We anticipate stabilization and cash out refinance in August 2020. Just sixteen months after purchase, proceeds should allow 45% initial equity repayment, and cash on cash 8-10% annually. Anticipated returns are 3.1X cash on cash, a 20% IRR, and an 8.1% “as complete" stabilized cap rate.

STABILIZED PROJECTS

Fairchild Shores

6211 N Kenmore, Chicago

Property acquired in August 2018. This 28-unit acquisition was purchased for $3.6 million, at 5.2% cap rate, with development cost of $750K. This property now features new kitchens, bathrooms, flooring, doors, windows, paint, plumbing, electrical and new hallway flooring. We also modernized the lobby, added laundry rooms on every floor, including new washers and dryers, updated mechanicals and resurfaced the parking lot. This property was stabilized from acquisition in 16 months. The development was completed in 11 months, which was three months ahead of schedule. Cash out refinance was completed in December of 2019, with an appraised value of $4.8 million, 15 months after purchase. Increased NOI 150%, 22% initial equity repayment, projected IRR 26%, cash on cash 8-10% annually, and achieved a stabilized 7.6% cap rate.

RECENT PROJECTS

2014-2017

Our recent projects included the purchase and development of six properties, since the inception of Fairchild Acquisitions. Approximately 50 units in total, with total acquisition cost of approximately $10 million. The renovation cost was approximately $1.5 million resulting in an overall value of more than $15 million.